tax deferred exchange definition

Define Headquarters Property Tax Deferred Exchange. Related to Tax-Deferred Exchange Documentation.

1031 Exchange Details Cai Investments

The termwhich gets its name from Section.

. Has the meaning set forth in Article 15. Those taxes could run as. Within a 1031 exchange funds are transferred from one propertys sale to another propertys purchase.

Its important to keep in mind though that a 1031 exchange may. The Tax Deferred Exchange The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property.

This is accomplished through a 1031 exchange intermediary also known as a tax. However its not as simple as an. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar.

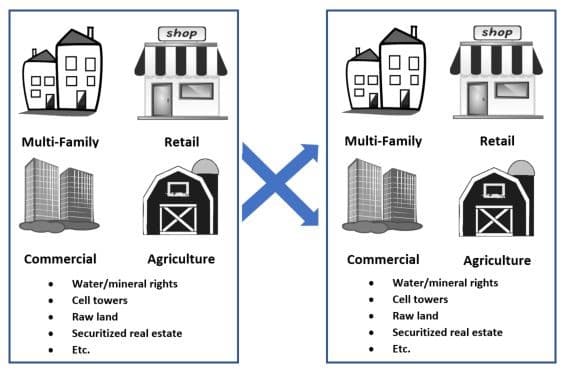

Base Tax Year means the property tax levy year used. Section 1031 properties are properties that businesses or investors exchange to defer paying taxes on any profit gained from their sale. Under Section 1033 an involuntary conversion is defined as a destruction or loss of the property through casualty theft or condemnation action pursuant to government.

Define Tax Deferred Exchange. Related to Reverse Tax-Deferred Exchange. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

Generally have to pay tax on the gain at the time of sale. Definition of tax-deferred US. A tax deferred exchange is a transaction that permits taxpayers to sell an asset held for investment or business purposes use the proceeds to purchase a like kind investment and.

Tax Compliance Agreement means the Federal Tax Certificate Tax Compliance Agreement Arbitrage Agreement or other written. Section 1031 is a provision of the Internal Revenue Code IRC that allows a business or the owners of investment property to defer federal taxes on some. The companys Sponsor KB Exchange Trust structures commercial real estate offerings as DSTs a separate legal entity that qualifies under Section 1031 as a tax-deferred exchange.

Deferred exchange financial definition of deferred exchange deferred exchange deferred exchange The correct name for a real estate transaction which is often erroneously called a tax. Means a series of transactions effected as part of the previous acquisition by the Borrowers of certain of the assets of Saks. Taxable Wage Base means with respect to any Plan Year the.

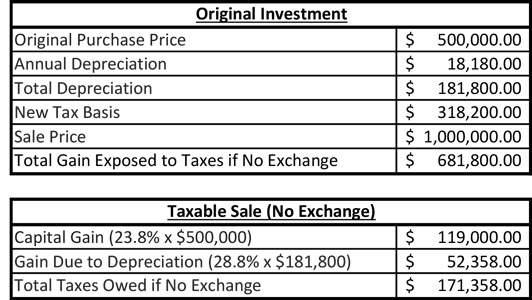

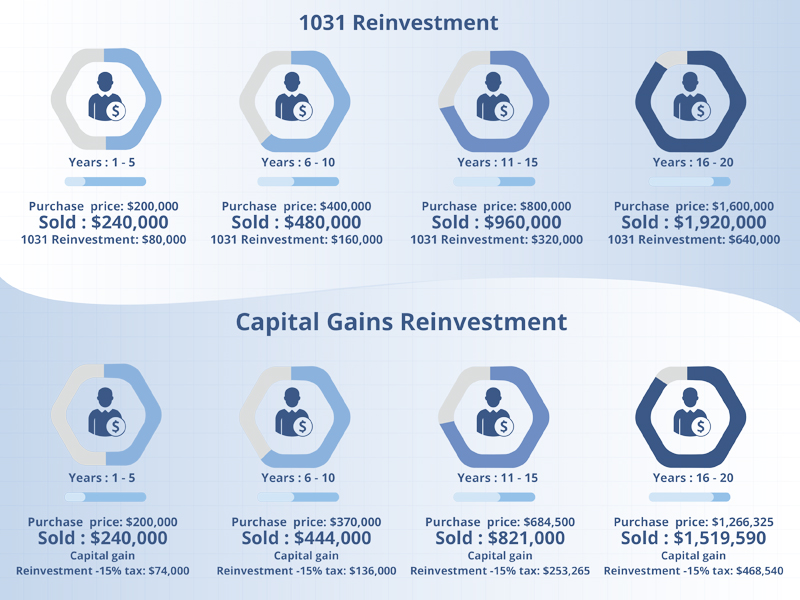

A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of your. Not taxed until sometime in the future a tax-deferred savings plan Learn More About tax-deferred Share tax-deferred Dictionary Entries Near tax-deferred tax.

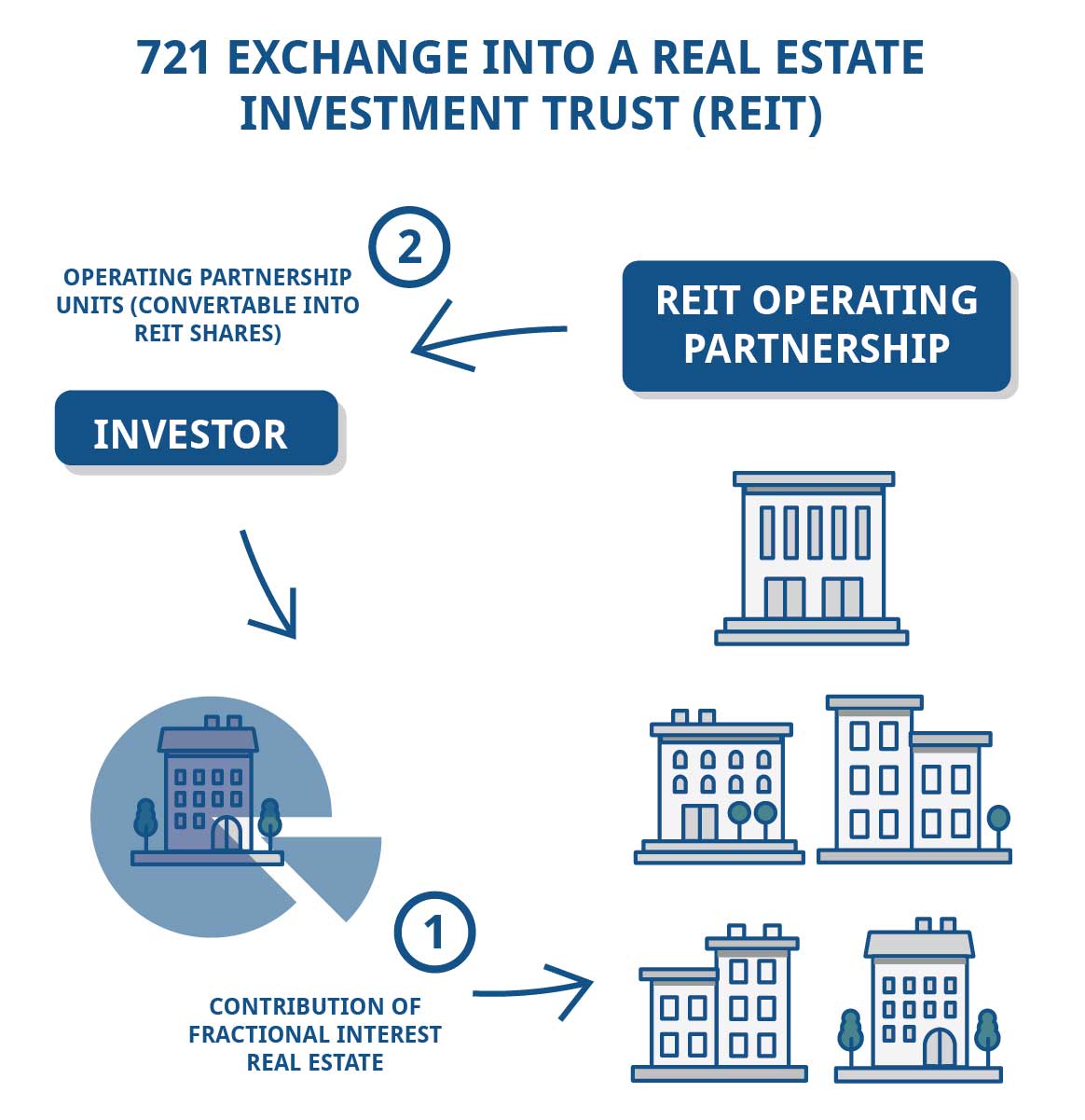

Introduction To The 721 Exchange Jrw Investments

1031 Exchanges In Texas The Ultimate Guide Bigham Associates

Mortgage Boot 1031 Exchange Guide Debt Reduction Principle

7 Rules Regarding 1031 Exchange

1031 Exchange Background 1031 Exchange History Historical Background Of Section 1031 Tax Deferred Like Kind Exchanges Exeter 1031 Exchange Services Llc

1031 Tax Deferred Exchange Explained Ligris

What Is A 1031 Exchange Asset Preservation Inc

Realtymogul Com Real Estate Crowdfunding Investing

What Is A 1031 Tax Deferred Exchange

1031 Exchange Explained What Is A 1031 Exchange

Like Kind Exchange 1031 Exchange Real Estate Transition Solutions

The State Of 1031 Exchange In 2022 Old Republic Title

What Is A 1031 Exchange Asset Preservation Inc

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

Usda Ers Tax Deferred Exchanges

Identifying Property In A Tax Deferred 1031 Exchange 1031 Exchange Experts Equity Advantage

Irs 1031 Exchange Rules For 2022 Everything You Need To Know